A deadline is coming up for parents who are receiving the new advance monthly child tax credit. It affects them in a couple of different ways.

The credit is $3,600 annually for children under age 6 and $3,000 for children ages 6 to 17. Eligible families will receive $300 monthly for each child under 6 and $250 per older child. It was part of the American Rescue Plan passed in March and the first payments went out in July and August.

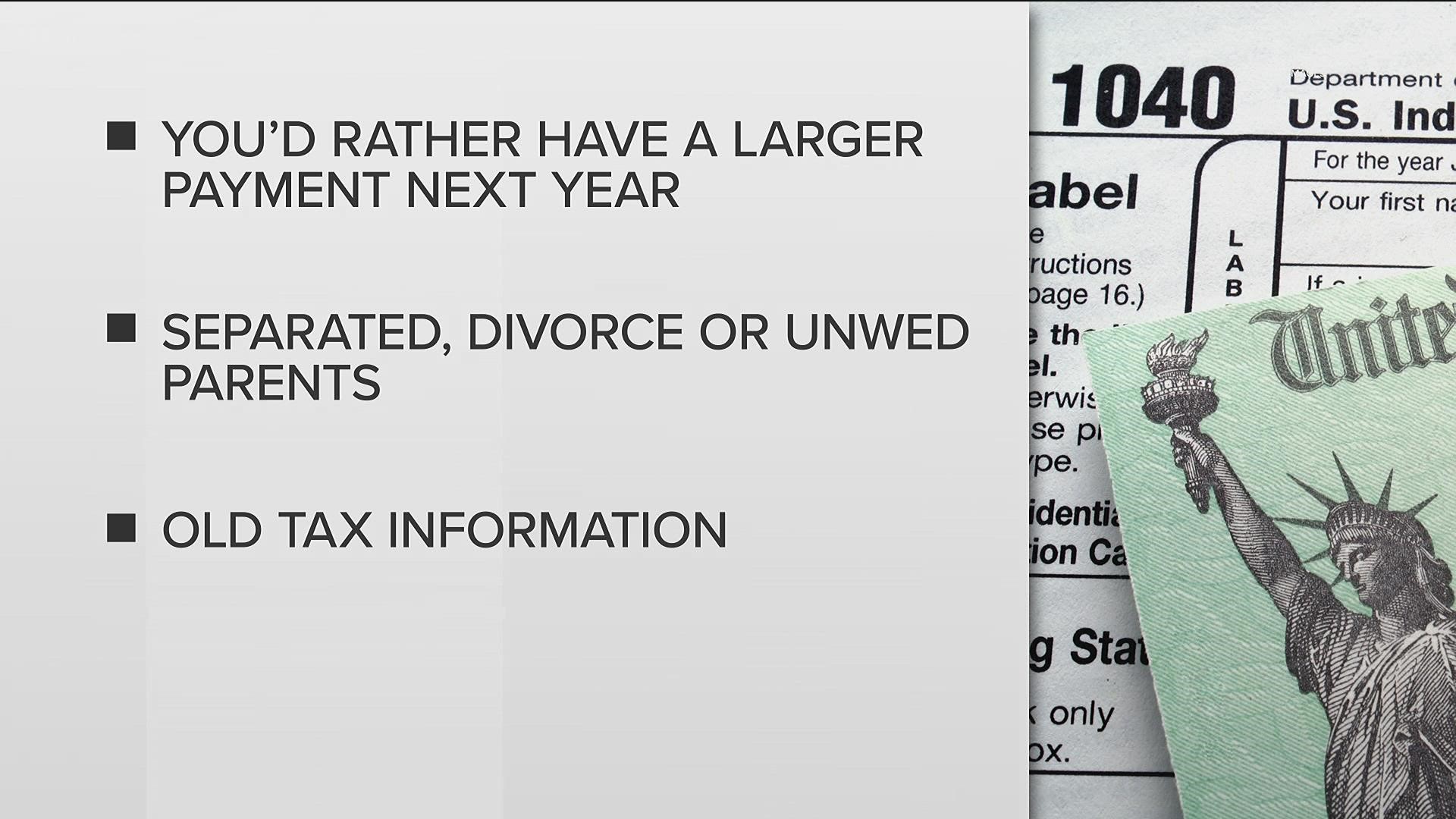

Those who are currently getting the monthly payment have until 11:59 p.m. ET on Monday, Oct. 4, to opt-out and get the money at tax time instead. Otherwise, they will get the payment on Oct. 15 or shortly thereafter. Opting-out can be done at the child tax credit update portal on the IRS website.

If the payment is going to a couple that files taxes jointly, both parents must opt-out. If only one unenrolls, then they will receive half of the monthly payment on the 15th.

Oct. 4 is also the deadline to update bank account or address information for the Oct. 15 payment. The IRS said last month that about 2% of payments were delayed due to a "technical issue" and that it primarily affected people who recently updated their information.

Any changes made before the deadline will apply to payments for the rest of the year, including the October payment. Changes made after will take effect starting with the November payment.

In the past, eligible families got this credit after filing their taxes — either as a lump-sum payment or a credit against taxes owed. But now six months of payments are being advanced monthly through the end of the year. A recipient receives the second half when they file their taxes in 2022.

Advocates argue the monthly payments make more sense for low-income families, but it is also a benefit to those in many middle-income households.

The benefits begin to phase out at incomes of $75,000 for individuals, $112,500 for heads of household and $150,000 for married couples. Families with incomes up to $200,000 for individuals and $400,000 for married couples can still receive the previous $2,000 credit.

If all the money goes out, the expectation is that could significantly reduce poverty — with one study estimating it could cut child poverty by 45%.

The payments are also a test case of sorts. President Joe Biden ultimately would like to make them permanent — and the impact they have could go a long way to shaping that debate as Congress considers Biden's $3.5 trillion budget plan.

Why was my child tax credit less last month?

One of the questions multiple people have asked is why their September child tax credit payment was less.

"There are multiple reasons why people may be seeing a different amount than they expected," the IRS said in a statement last week. "If only one spouse changed an address or bank account, the other spouse’s half could be going to the old address or bank account. In these instances, the full payment will still be distributed."

The agency said if a tax return was recently processed, that could also change the amount received. The credit goes out to eligible Americans who filed a 2019 or 2020 tax return or those who aren't required to file a return but used the online non-filers tool.

"We encourage people to check the IRS CTC Update Portal for the latest payment information," the IRS said.

The Associated Press contributed to this report.