TOLEDO, Ohio — Looking around for cheap gas may have you coming up short.

Not only are we paying more at the pump, there's also been an overall increase in the costs of living.

There's a good chance those prices won't be coming down any time soon. So now, even more than usual, it's important to balance that budget.

Financial advisor Lou Ramirez explained that budgeting is key for everyone to stay afloat during this inflation. He added there isn't one specific current event that is solely to blame for this economic influx. Yet, while there's specifically no one reason to blame for the current financial, now is not the time to panic.

Especially since the last 11 years, the economy has overall been great, with a few minor hiccups Ramirez said.

"We now have two and half months of setback," Ramirez added, "I think it's irrational to think that you're never going to have setbacks."

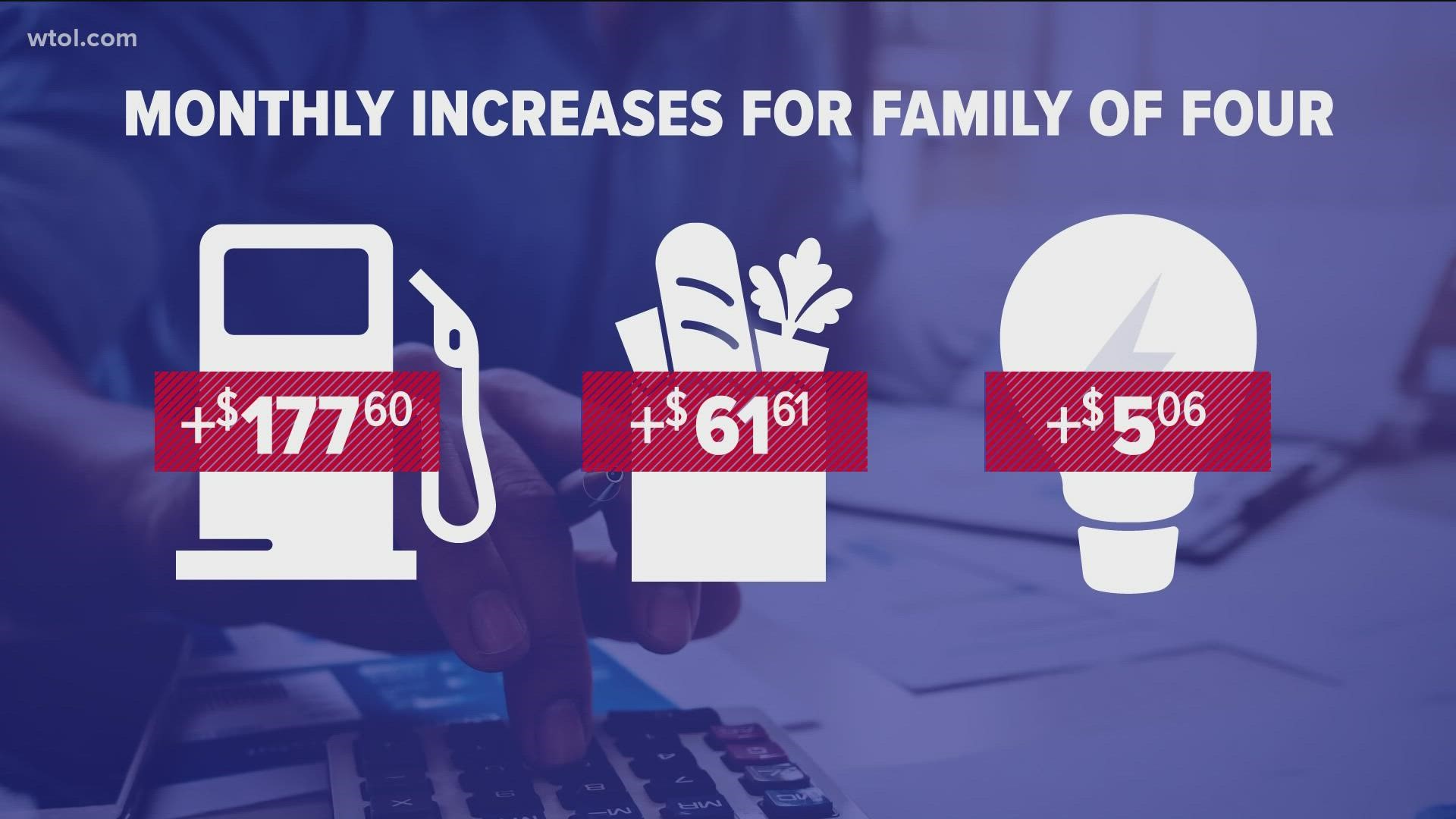

Taking a look at the cost for an average family of four in Toledo, WTOL 11 found:

- Gas is up almost $1.50 per gallon over last year, meaning it costs about an extra $180 to fill up two cars, each week for a month, according to Toledogasprices.com

- Groceries are up more than 6%, putting that bill a little over $60 a month, according to the USDA

- Electricity costs rose more than 4% at another $5 a month, according to the U.S Bureau of Labor Statistics

This makes the final total just under $250 each month or nearly $3,000 a year more than in 2021. This tally does not account for inflation on other things the family may buy.

It's all about spending on what you need versus what you want.

"We have to have a roof over our head. We have to have food, we have to feed our children. We have to have clothing," Ramirez said. "I would say those basic necessities are the first place you have to be willing to spend money."

That means it's smart money-spending, without the need to go overboard.

Ramirez noted the best thing to do is speak with a financial planner or sit down and budget your household items out.

Additionally, Ramirez says to watch the news and read up on better money and financial practices to help you plan for the future.