Double check privacy settings and lock information down.

Security experts remind anyone paying people or receiving money through popular apps like Venmo, Paypal, Apple pay, and Cash App to make sure they aren't oversharing.

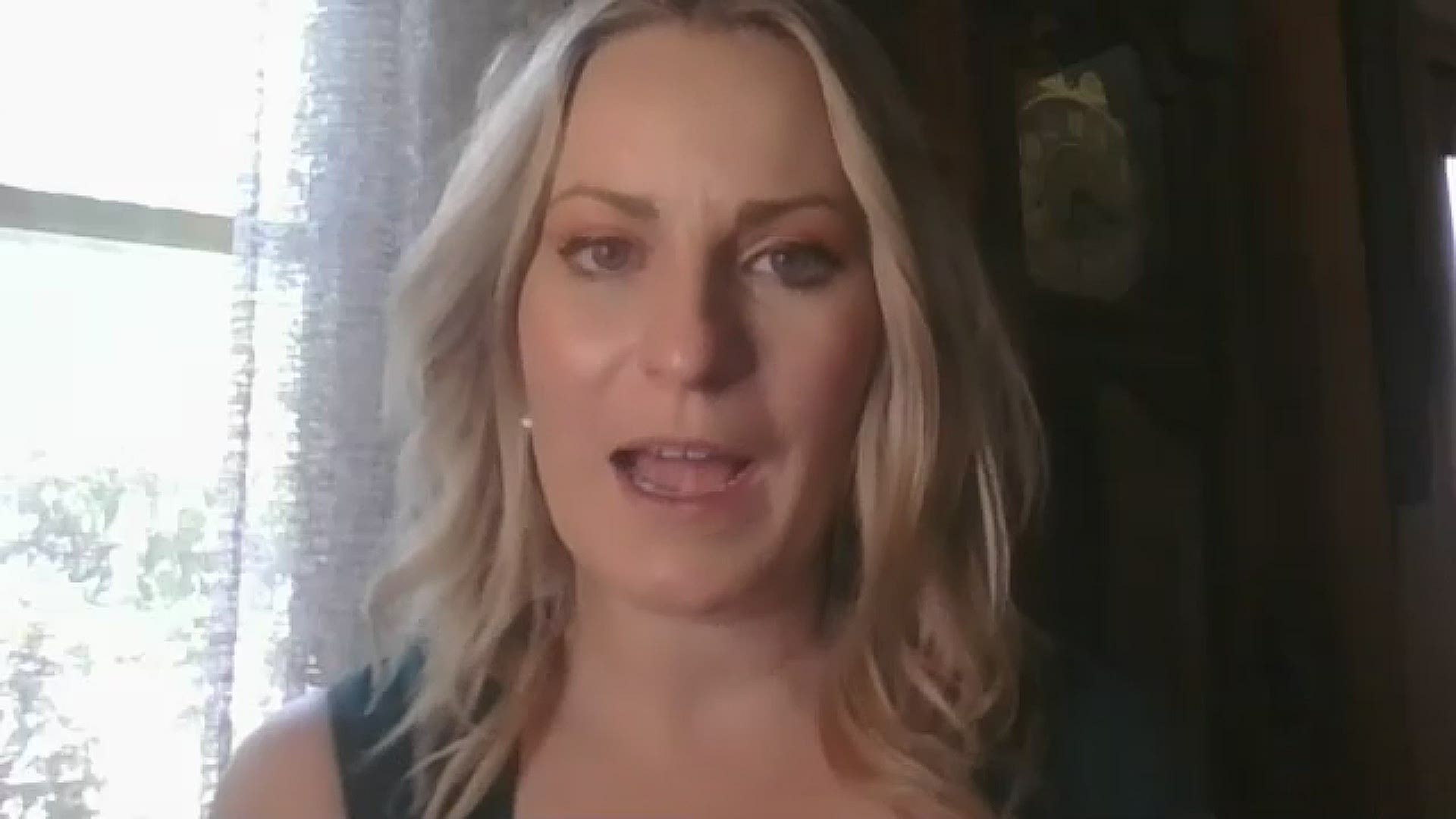

"One of the things my friends and I in cybersecurity like to say is there is no fix for carelessness," said Dr. Tamara Schwartz, a cybersecurity expert at York College of Pennsylvania. Experts remind everyone scammers and identity thieves have also been watching the popularity of money sharing apps grow during the COVID-19 pandemic.

Many people publicly share posts on payments for their vacation destinations, favorite restaurants, and large gifts. Those public posts, cyber experts warn, could be seen by anyone including people you may not know may be viewing them.

"I would start with the privacy settings," said Dr. Schwartz, who also reminded people to keep the apps locked whenever they are not in use. She said many of the apps do not provide the same protection against fraudulent charges as credit card companies do.

"Once you send the money they (the scammers) delete the account and take the money with them," she said as she also reminded everyone "I would always use 2 factor identification anytime. Don't turn that off."

Dr. Schwartz admits the COVID-19 pandemic has forced more people to begin using digital currency and she acknowledges it is likely to become more of the norm in the future.

Listen to Dr. Schwartz share her advice to consumers:

Angie Fitzgerald of Montgomery County knows all about the importance of carefully monitoring money apps.

She was using 'Cash App' to send money to friends and family and to receive funds for her small business.

"If I had some extra money I would use it to purchase stock through Cash App," she said. But one day she tried to log on to find that her account had been locked and she was unable to access the $650 she had earned on those stocks.

Fitzgerald was able to get her problem solved after going public with her story. But, the experience has left her more cautious about apps in the future.

"I feel really badly for the people who were affected who didn't get their money back. And, I would just say be super uber careful," said Fitzgerald.

Listen to Fitzgerald share her story:

If you use Cash App, here are some ways to avoid scams:

The app is working to educate users about potential scams. They've shared information about how to avoid scams on the Cash App Support Twitter, the Cash App Twitter, contact Cash App link on our website, and within Cash App Support which can be found online or through the app.

On Cash App, scams can be reported in the app. An AI-driven feature flags potential spam or scams for payments in the app. Customers can also block a given sender or recipient. Outside the app, it's also started deploying SMS text messages with links to customers when they suspect that login attempts look unusual. If a customer is sending money to a person who the app thinks is not in their contact list, it will double prompt them to make sure they want to send money to the account. If you believe you have fallen victim to a scam, you should contact Cash App Support through the app or website immediately. As a reminder, the Cash App team will never ask customers to send them money, nor will they solicit a customer’s PIN or sign-in code outside of the app. Cash App's phone number is1-800-969-1940 and customers and non-customers can contact us through that number 7 days a week. Cash App employees are often impersonated by scammers circulating fake phone numbers online. Never call anyone claiming to represent Cash App at any other number. And remember that Cash App will never ask for your PIN or sign-in code.

TIPS FROM PAYPAL

Late last year PayPal took a look at how the pandemic has impacted shopping behaviors among consumers and businesses. Find more in the “How We Shop Report: A Look at the New Consumer and Merchant Reality” here